Is an AARP Member Worth Anything? Some Reviews of AARP’s Best Benefits

8 min read

As retirement planning and senior benefits continues to change every year, many individuals nearing retirement age may wonder whether organizations like AARP can actually help you save money. AARP discounts are one thing, but it has long been known for its advocacy and resources for older adults. With changing times and new alternatives emerging, it’s important to think about whether AARP membership remains a valuable investment in 2024.

You may have received mail from AARP encouraging you to join. But is an AARP membership really worth it?

Quick Take: What Is AARP?

AARP, the nation’s biggest nonprofit, nonpartisan entity, aims to empower citizens aged 50 and above to make the right choices as they grow older. Members receive discounts on everything from healthcare and travel to financial services, shopping and entertainment. The group also provides advice on careers, caregiving and other topics.

AARP publishes “AARP The Magazine,” a print publication with celebrity interviews, health and tech feature articles, recipes, and entertainment reviews.

AARP Membership Benefits and Discounts at a Glance

Are there any real benefits to joining AARP? AARP’s Member Benefits page currently boasts more than 300 perks, including hotel stays, vacation packages, gift cards, credit card rewards and discounts on a wide range of products and services. In the table below, you’ll find just some of the discounts you can receive and resources you can expect to gain access to:

| CATEGORY | BENEFITS AVAILABLE | ||

| Retail | Naked Wines, Proflowers, FTD, Schwan’s Home Delivery, Walgreens, The UPS Store | ||

| Travel | AARP Travel Center includes promotions for Avis, Budget car rentals, Payless Car Rental, Zipcar car sharing, cruise packages, flights, hotels, roadside assistance, travel planning | ||

| Restaurants | Bubba Gump Shrimp Co., Denny’s, Rainforest Cafe, Bonefish Grill, Carrabba’s Italian Grill, Outback Steakhouse, Landry’s | ||

| Entertainment | Ticketmaster, Book of the Month, Ancestry | ||

| Advocacy | AARP State Offices, AARP Foundation Litigation | ||

| Community Events | AARP Near You, AARP Virtual Community Center | ||

| Healthcare | Dental, vision, short- and long-term care insurance, pet insurance, Medicare-eligible plans, prescription medications | ||

For a complete list of benefits and terms and conditions, you can visit AARP’s Member Benefits page.

Is AARP Worth It? Some Reviews of AARP’s Best Benefits

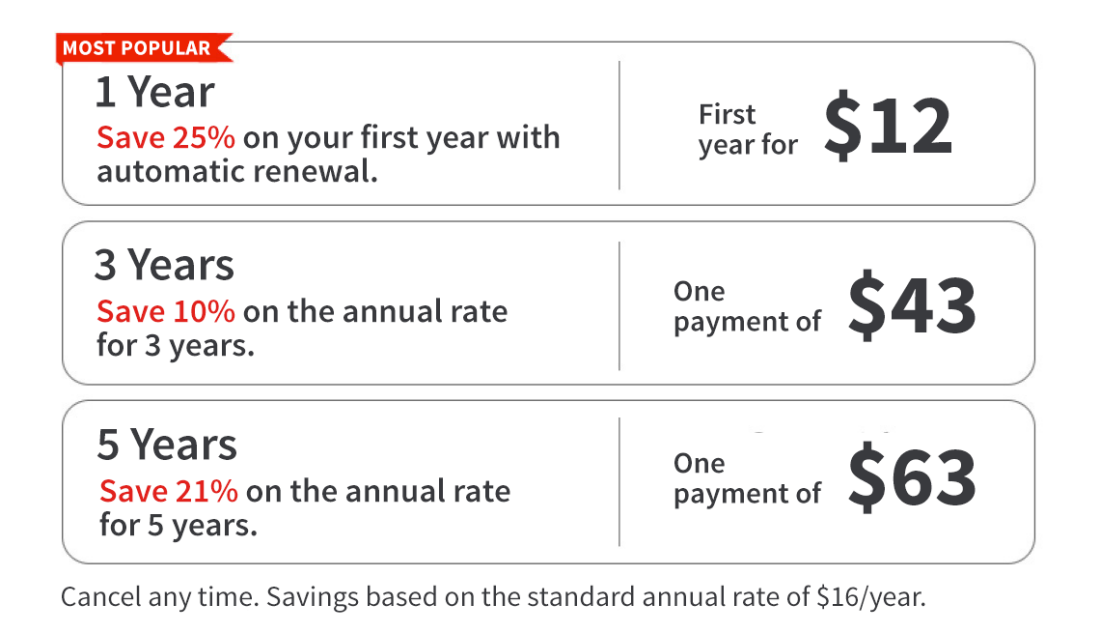

Based on current pricing, the most you’ll pay for an AARP membership is $16 per year. AARP’s exhaustive list of benefits includes discounts that could pay for your membership the first time you use them. To get an idea of how easily you can recoup the cost of joining, consider the following potential savings you can get on travel and shopping alone:

Is AARP Worth It for Travelers?

Whether you’re a frequent or occasional traveler, the travel discounts you can earn with an AARP membership can be well worth that yearly membership fee. AARP’s benefits page shows several travel-related car rentals, packages and deals you can receive.

For example, you can get $100 off per person if you sign up for a Grand European Travel package for one of over 30 river cruises in Europe, Asia and Egypt. You can also save $50 to $100 per person on guided land, river or rail tours by Collete.

Here are some other travel perks members receive:

- 5% off Vacations by Rail cruise tours

- $65 to $200 off British Airways flights

- 12% off reservations at Park Ride Fly USA locations, plus luggage assistance and airport shuttle

- 10% off stays at a long list of hotels and resorts

- Up to 30% off base rental car rates at Avid and Budget

What Kind of Shopping Discounts Do AARP Members Receive?

The many discounts you can get at local and nationwide retailers can also make an AARP membership worth it. For example, members get a $110 voucher for a purchase of $139.99 or more from Naked Wines, 30% off gifts from FTD and 5% to 15% off products and services at The UPS Store.

Other shopping discounts include:

- 10% off Laundry’s Kitchen make-at-home meal delivery service

- 20% of your first $50 order from Schwan’s Home Delivery

- Exclusive Walgreens Cash rewards

If you’re a frequent Amazon shopper, you may wonder if an AARP membership can help you save on an Amazon Prime membership. Unfortunately, you won’t currently find a discount for an Amazon Prime membership on AARP’s Member Benefits page.

Become an AARP Member Today >>>

AARP offers big discounts tailored to its members

One of the main benefits AARP offers is a wide array of discounts tailored to seniors’ unique needs and lifestyles. For example, AARP offers discounts on home office equipment and ergonomic furniture, which can be particularly beneficial for older workers who may be transitioning to home-based work or starting encore careers.

AARP offers many other types of discounts, too, including health and wellness discounts. Through AARP, members can access reduced rates on gym memberships, fitness trackers and even telemedicine services — all of which may be crucial for staying healthy during your senior years.

And, travel discounts have been, and remain, a cornerstone of AARP benefits. In addition to traditional hotel and car rental discounts, AARP members can take advantage of deals on vacation rentals, adventure travel packages or even RV rentals.

Membership comes with access to financial services

AARP membership also offers access to a wide range of financial services, which include access to financial planning tools, investment guidance and educational resources that are tailored to the unique challenges faced by those in their 50s and beyond. These services can be particularly beneficial for seniors navigating the complexities of retirement planning, estate management and financial security in later life.

One key offering is AARP’s partnership with financial institutions to provide members access to high-yield savings accounts and certificates of deposit (CDs) with competitive rates. For seniors living on fixed incomes or looking to maximize their savings, these options can help preserve and potentially grow their savings.

AARP also provides free access to retirement calculators and financial planning tools. These resources can help seniors assess their current financial situation, estimate future expenses and adjust their strategies accordingly. This is especially crucial for those approaching retirement or in the early stages of their post-work life.

The organization also provides educational resources on topics like Social Security optimization, Medicare planning and long-term care insurance. These subjects can be dauntingly complex and AARP’s guidance can help seniors make informed decisions that significantly impact their financial well-being.

Seniors are offered career resources through AARP

Membership also comes with access to AARP’s career services, which are designed to address the unique challenges and opportunities faced by older workers. These resources can be particularly valuable for seniors who want to continue working or re-enter the workforce after retirement — or for those who need to find ways to supplement their incomes.

One key offering is AARP’s job board, which features listings from employers who have committed to age-diverse hiring practices. This can be crucial for older job seekers who may face age discrimination in their search.

For those considering entrepreneurship, AARP offers resources on starting and running a small business. This includes guidance on writing business plans, securing funding and leveraging technology for business growth, all tailored to the unique perspectives and challenges of older entrepreneurs.

The organization also offers a range of other career-related resources, like virtual career fairs and webinars and articles on navigating the modern job search process. These resources can help seniors adapt to current job search practices that may have changed significantly since they last sought employment.

Become an AARP Member Today >>>

Members can access healthcare resources and guidance

Navigating the healthcare system can be daunting, especially as one approaches Medicare eligibility. And, AARP has positioned itself as a valuable resource in this area, offering members comprehensive information and guidance on Medicare, supplemental insurance and long-term care options.

But guidance isn’t the only healthcare-related benefit that comes with membership. AARP’s Medicare Supplement insurance plans can also provide additional coverage to help seniors manage out-of-pocket expenses. While these plans are available to non-members as well, AARP members often receive preferred rates.

Members can also access tools to help estimate healthcare costs in retirement, understand their options for long-term care and make informed decisions about their health coverage. In an era where healthcare expenses can quickly derail retirement plans, this guidance can be invaluable.

The organization advocates for issues affecting older Americans

While not a tangible benefit like discounts or services, AARP’s advocacy efforts represent a significant reason to consider membership. After all, AARP lobbies for policies that benefit older Americans across a wide range of issues, including healthcare reform, retirement security and protection against fraud and financial abuse.

The organization also advocates for issues like support for family caregivers, expansion of high-speed internet access in rural areas and policies to make communities more livable for people of all ages. So by joining AARP, seniors lend their support to these advocacy efforts, potentially influencing policies that could have a direct impact on their lives and the lives of future generations.

How Old Do You Have To Be To Join AARP?

Full membership is available to anyone age 50 and up, even if you’re not retired or nearing retirement. Associate memberships are available to younger individuals, although some benefits might be limited.

What Is a Good Age To Join AARP?

Any age is good to join as long as you have reviewed the benefits and discounts and determined you’ll use them enough to cover AARP’s membership cost.