- Upstart offers personal loans for three- or five-year terms, allowing you to take out a loan between $1,000 to $50,000. However, minimum loan amounts can vary by state.

- Upstart’s fixed personal loan rates range from 7.8% to 35.99% annual percentage rate (APR).

- Upstart is considered a reputable company, with an A+ rating from the Better Business Bureau (BBB).

- Upstart is best for borrowers with bad credit, but charges more fees than our highest-ranked lenders.

While many lenders require a good to excellent credit score, Upstart is designed for those with poor credit. You can borrow between $1,000 and $50,000. Upstart is not a direct lender — it’s a lending marketplace that can match you with eligible banks and credit unions when you apply. While this is good for comparing options, it may result in texts, emails and phone calls from multiple lenders.

Our Take on Upstart

Upstart is best for applicants with bad credit and offers a temporary hardship program to lower monthly payments if you lose your job unexpectedly. Upstart doesn’t advertise this program, so we at the MarketWatch Guides team reached out for more information. The representative stated the temporary hardship program typically lowers payments for up to two pay periods, and eligibility varies on a case-by-case basis.

Upstart is not the actual lender for personal loans, but an AI-powered marketplace with numerous partner financial institutions, including credit unions such as Alliant Credit Union.

- Minimum credit score: The minimum credit score is 300 to be approved for an Upstart loan. This is especially low compared to other lenders.

- Loan amount: Upstart personal loan amounts range from $1,000 to $50,000.

- Loan term: Upstart personal loans have two repayment terms, three or five years.

How We Rate Upstart Personal Loans

We score Upstart personal loans 4 out of 5 stars (80 out of 100 points). The overall scoring was calculated from data on four main categories: affordability, loan features, customer experience and company reputation. We also considered features like the ability to pick loan terms, potential fees and rates.

- Affordability (28/35): Upstart has one of the lowest starting APRs, but its loans can include hefty fees — including up to a 12% origination fee. Other big lenders, like Discover, don’t charge an origination fee at all. While there is no early penalty for paying off your loan early, late payment fees and failed bank transfer fees can be charged.

- Loan features (25/35): Compared to other lenders, Upstart offers a narrower range of loan terms and amounts. Only two terms are available — three or five years — with a $50,000 loan limit. For comparison, SoFi personal loans offer a range of two to seven years, with a $100,000 loan limit.

- Customer experience (17/20): Upstart has an excellent customer service rating due to its soft credit check prequalification option, 50 state availability and seven-days-a-week phone support.

- Company reputation (10/10): Upstart has the highest possible rating from the BBB.

Another noteworthy loan feature is Upstart’s quick funding, which can be as soon as the next business day. In March 2024, 62% of Upstart customers received their funds within 24 hours of approval and signing, according to Upstart. This is faster than LendingClub and Axos, which take at least two business days to fund your loan.

If your loan application is accepted before 5 p.m. on a weekday, your money will be transferred the next business day, the company promises. If you accept your loan after this cutoff, the money will be sent the following business day. If Upstart requires additional documentation, funding could take longer.

It’s important to note your loan minimum will be higher than Upstart’s $1,000 advertised minimum loan if you live in Georgia, Hawaii or Massachusetts. Those state minimum loan amounts are $3,100, $2,100 and $7,000, respectively.

Get Pre-Qualified with Upstart >>>

Will I Qualify for an Upstart Personal Loan?

You could qualify for an Upstart personal loan if your credit score is above 300 and your income is deemed sufficient to pay back the loan. The following is not an exhaustive list, just a shortened example of basic Upstart loan qualifiers.

You must meet the following basic eligibility requirements:

- Be at least 18 years old with a valid email address

- Have a verifiable name, date of birth and Social Security number

- Have a personal banking account at a U.S. financial institution with a routing transit number

Certain statistics suggest it is easier to qualify for an Upstart personal loan than other top lenders. More than two-thirds of Upstart loans are approved instantly and fully automated, according to a press release.

Our First-Hand Experience Applying for an Upstart Loan

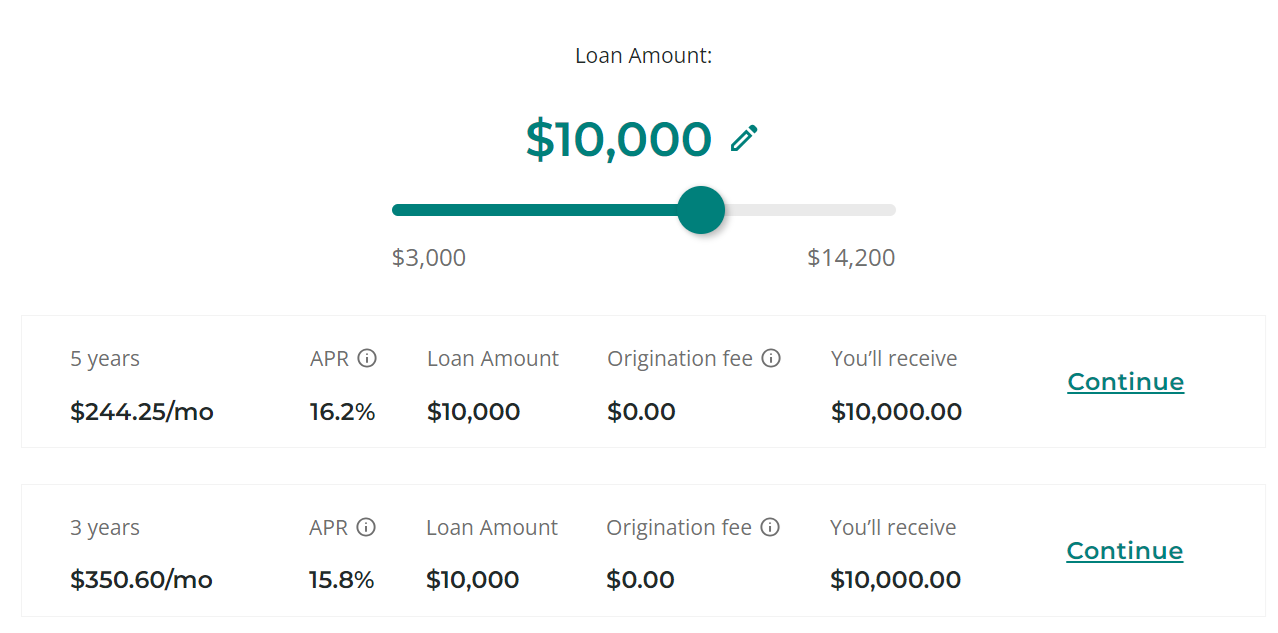

One of our MarketWatch Guides researchers applied for an Upstart personal loan of $10,000 with a 759 credit score and received rates of 16.2% APR and 15.8% APR, for a five- or three-year term, respectively. Our loan did not have an origination fee.

We applied for the loan on May 29 and had until June 11 to decide. We like that the application had an extended acceptance period so customers don’t feel rushed to decide.

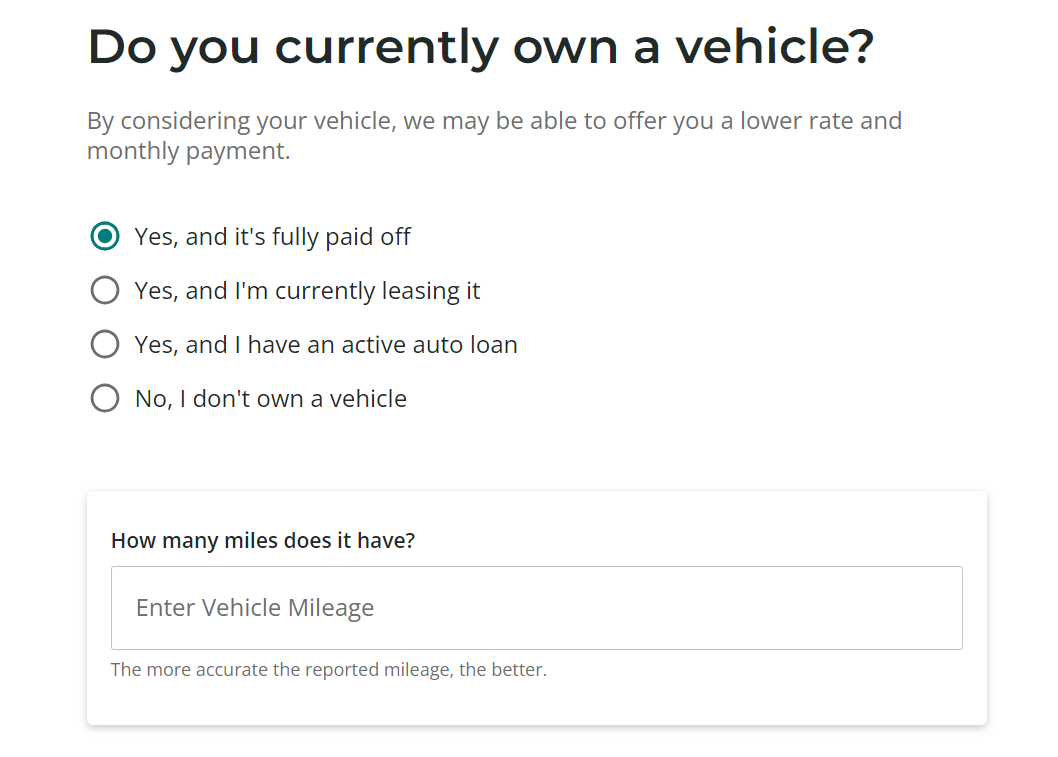

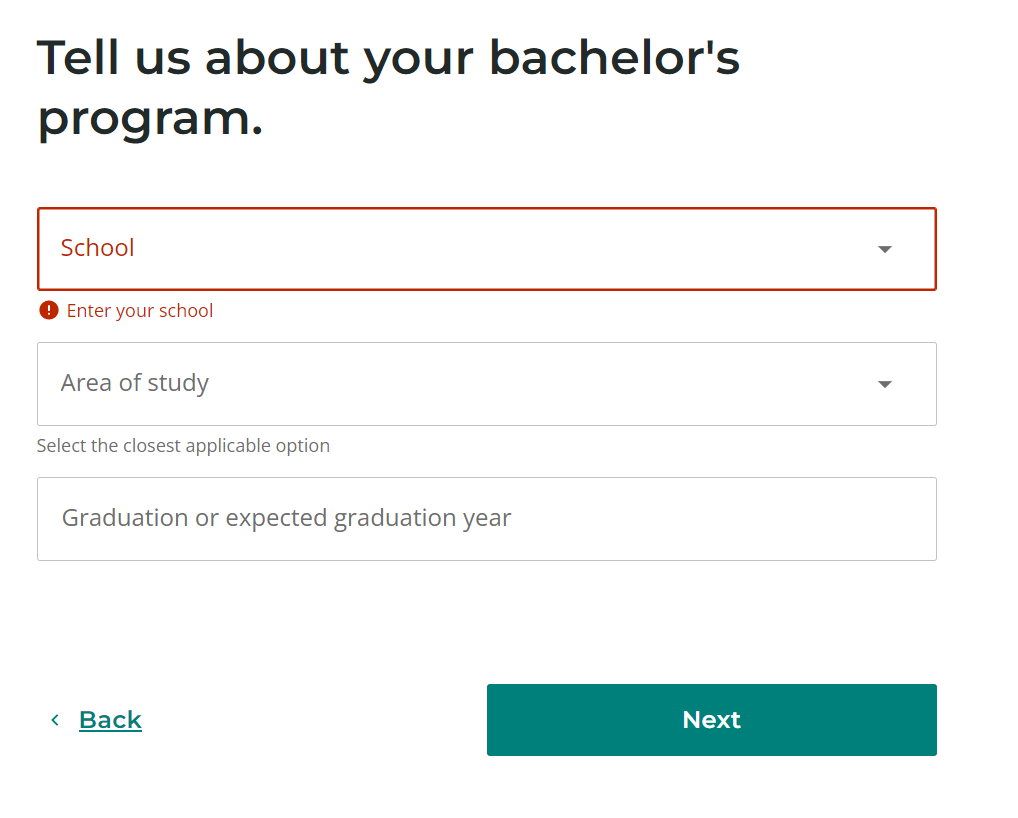

We found the application to be unnecessarily extensive. It asked for information like car mileage, education level, how much you have in savings or investment accounts, what month and year you started your current job role and if you have taken out a loan within the past three months. This isn’t information most have ready on the fly, which is highly inconvenient. All questions were required to be answered.

Get Pre-Qualified with Upstart >>>

Credit Score and Financial History

Your credit score needs to be 300 or above on at least one of the consumer reports received in connection with your application. You must have a strong financial history, and there can’t be any abrupt changes to your credit report or debt history.

Below are several factors that could result in your Upstart loan being denied:

- Significant drops in your credit score or additional debt obligations.

- Failure to meet the minimum debt-to-income requirement of 45% in New York, Maryland, Connecticut or Vermont and 50% in all other areas.

- Bankruptcies on any of your consumer reports within the last 12 months.

- Six inquiries or more on your credit report in the last six months, not including any inquiries related to student loans, vehicle loans, or mortgages

Helpful Tip: If you have good credit (above 680), you could qualify for a SoFi loan instead, which has no fees and a higher loan borrowing limit (up to $100,000).

Income and Employment

We found Upstart’s required income and employment information to be unnecessarily extensive. Upstart requests your area of study, which doesn’t seem relevant to the loan, and Upstart states its bank partners don’t have a minimum educational requirement to be eligible for a loan.

You must have some form of income, a job or have accepted a job that you’d start within the next six months to qualify. You’ll need to input this information in your loan application. If you’re salaried, Upstart requests your title, the name of the company you’re employed by along with your start month and year.

Upstart Personal Loans Reviews

Our MarketWatch Guides team reviewed thousands of reviews from popular publicly available user-review sites including Trustpilot, the Better Business Bureau, Consumer Affairs and Best Company to give you an idea of how customers feel about personal loan companies.

We categorized each review to determine whether it was positive or negative. With that data, we normalized scores against each other to create a standard. We generated numeral scores to gauge Upstart’s ease of use, responsiveness, transparency, reliability, and customer service as it relates to other lenders. Scores do not guarantee your experience and are only intended to convey general trends.

Upstart’s Overall Consumer Sentiment score is 4.3 out of 5 stars, which is positive. Below, we break down individual scores for Upstart.

- Ease of Use: 4.4

- Responsiveness: 4.3

- Transparency: 4.5

- Trust and Reliability:4.9

- Customer Service: 4.8

Most Praised Features

- Speed and efficiency of loan processing: Customers applauded the quick and simple loan process. More than half (53%) of positive reviews praised the speed of the loan process.

- Helpful customer support: Support was noted as accessible and helpful, which improved user experience. More than 20% of positive reviews praised Upstart’s customer service.

Most Common Complaints

- Minimal: There were very few complaints, with an occasional mention of needing more transparent communication on specific terms or conditions.

Get Pre-Qualified with Upstart >>>

Who Are Upstart Personal Loans Best For?

Upstart personal loans are best for people with bad credit and therefore less of a chance of approval with other lenders. Upstart approves loans for borrowers with a credit score as low as 300, also considering their education and employment.

Edward Sanchez has a poor credit score and needs $10,000 for home improvement

Edward’s loan is within Upstart’s loan range and doesn’t risk his home as collateral as he would with a home equity line of credit (HELOC). Upstart’s low credit score requirement makes it likely Edward will be approved for his loan.

Ngyuen Lin wants to quickly get rid of $20,000 in outstanding credit card debt

Ngyuen’s loan request is under $50,000, which is within Upstart’s limits, making him a potentially eligible candidate. Because Ngyuen wants to get rid of his debt quickly, he could benefit from Upstart’s speedy funding, which can take as little as 24 hours.

Pros and Cons of Upstart Personal Loans

Pros

Low minimum credit score: Those with poor credit (as low as 300) could be approved for an Upstart personal loan.

Temporary hardship program: If you face a financial hardship, you could qualify for Upstart’s temporary hardship program, which will lower your monthly payments for a limited time.

High rating from BBB: Upstart has the highest possible rating from the BBB, which indicates they make an effort to resolve customer complaints.

Quick funding: Your personal loan could be funded in as little as 24 hours.

Praised customer service: Customer service is highly praised in reviews and its phone customer service is available seven days a week.

Cons

Extensive fees: Fees are costly compared to other lenders, with a 0% to 12% origination fee, $15 ACH return or check refund fee and $15 late penalty fee.

Lengthy application process: We found the application process to be unnecessarily long, asking questions that didn’t seem relevant to the loan.

The loan minimum amount varies by state: Minimum loan amounts are higher if you live in Georgia, Hawaii or Massachusetts. Those state minimum loan amounts are $3,100, $2,100 and $7,000, respectively.

Limited loan terms: Upstart only offers two terms, three or five years.

High APR rates: Upstart’s APR goes up to 35.99%, when most lenders stay under 30% as their APR maximum.

Get Pre-Qualified with Upstart >>>

Upstart Personal Loans Usage Rules

Upstart generally allows you to use your personal loan to cover most costs, such as debt consolidation, medical expenses, home improvement projects, a move, a wedding or even a vacation.

However, Upstart doesn’t allow you to use your personal loan as a down payment on a home mortgage loan. Lenders typically don’t allow personal loans to cover tuition or business expenses, but Upstart didn’t clarify if these restrictions apply to its loans.

We contacted Upstart for clarification, but the answer was still unclear. The representative stated restrictions vary, depending on which loan partner Upstart hands off your application to. Once you complete your application, you should be able to see if you can use your loan to pay for business or tuition costs.