What is credit and how does it work?

9 min read

What exactly is credit? Credit is receiving something of value now with the promise to pay for it later. Think about it this way…

What financial goals do you hope to achieve before you’re 30? Or better yet, before you retire?

Many Americans are looking forward to owning a home, buying a car, or even a boat one day. But unless you strike it rich, you’re going to need to use credit to qualify for financing to purchase these items.

And the same holds true if you want to do other common “adulting” things, such as renting an apartment or buying a mobile phone service.

If you’re not already familiar with credit and how it works, you’re not alone. One survey shows most Americans don’t know how common actions can affect their credit scores.

But we’ve got you covered. Read on to get a better understanding of everything you need to know about credit reports, credit scores, and how to use credit.

What is credit and how does it work?

In a nutshell, credit refers to the ability of a customer to obtain a loan for goods or services before payment, based on the trust that payment(s)will be made in the future. Lenders will check your credit score to determine whether or not you’re credit-worthy. So you’ll need a good credit history and therefore a good score, to improve the odds of getting approved and being able to borrow money (with a favorable interest rate).

to improve the odds of getting approved (with a favorable interest rate).

One way you can establish credit history is by entering into a credit agreement with a lender, where you’ll be responsible for making repayments within a given timeframe. An example of this would be getting a credit card, using it to purchase goods and then paying the bill on time, and keeping low credit utilization. Another option would be a credit builder loan which allows you to take on a small amount of debt, and then repay it in installments to demonstrate that you’re a reliable borrower. The difference between a credit builder loan and a regular loan is that the loan amount is held in a secure bank account until you’ve finished making your repayments. Because the purpose of the loan is to build your credit history, you receive the money from the loan at the end (minus interest and fees) instead of the beginning.

When building your credit, you’ll need to keep an eye on your credit report and credit score.Your credit report is what shows the credit accounts you have opened, closed, or in delinquent status. And based on your credit report (and how good or bad it is), you’ll receive a credit score. But more on that in a minute.

Your credit matters because it can determine whether or not you’re approved for things like a lease on an apartment or used car loan.

For example, some landlords will only rent to tenants with a 650 or higher credit score and no evictions on their credit report.Keep in mind the number can vary greatly depending on building type and location. Others may still rent to you without these criteria, but then you may have to pay a higher deposit to move in.

See Your Credit Score instantly! >>>

What is a credit score?

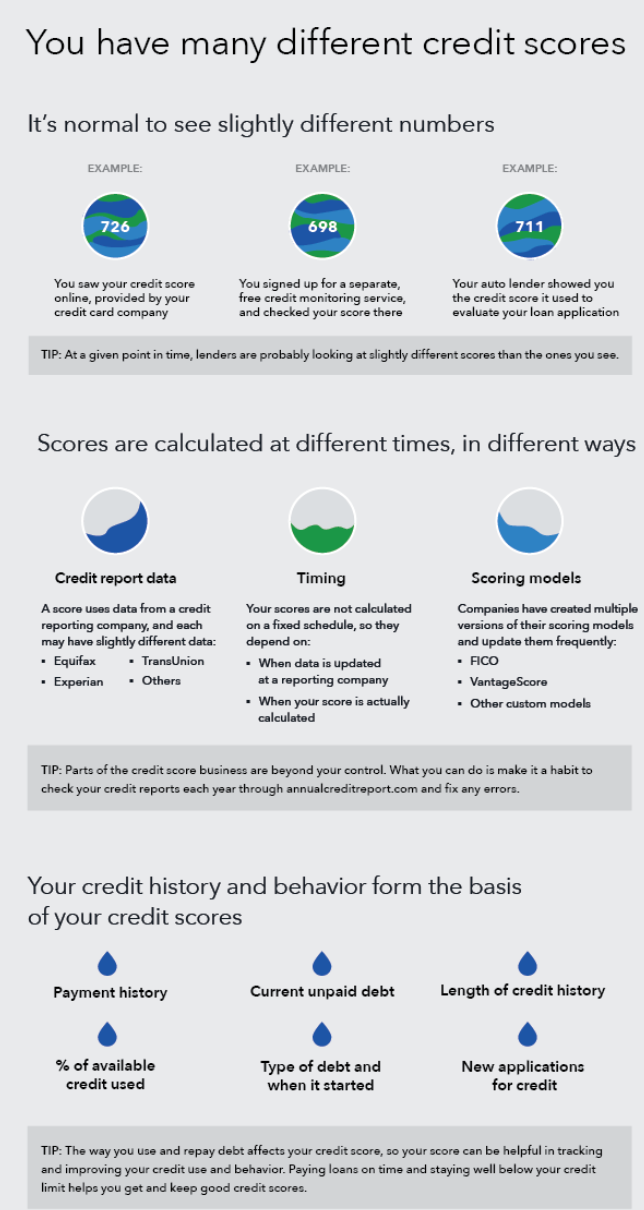

Your credit score is a number assigned to you based on what’s in your credit report. There are various factors used when calculating your credit score. Now, where things can get confusing is the various credit scoring models used by different financial institutions.

Lenders, creditors, and some landlords typically have a minimum score for automatic approval. Anything lower will require additional deposits, documents, or arrangements, or you may not get approved at all. Your credit score is not the only factor that affects whether you’ll be approved for a loan. Things like debt-to-income ratio and down payments also have an impact.

Where the creditor pulls your credit from will determine the score they see. If you check your own credit score using a tool like Credit Karma, you’ll find a credit score based on the VantageScore 3.0 model (VantageScore 4.0 is now here). Then some banks choose to use FICO® Score 8 model.

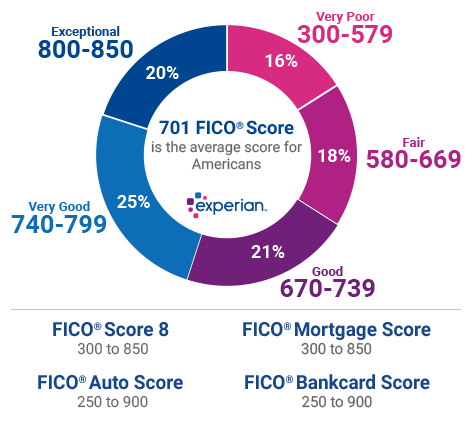

There are different credit score ranges to identify whether you have exceptional credit or poor credit. You’ll also find some scoring models have lower and higher thresholds. For example, the FICO Score issues scores between 300 and 850, while FICO Auto Score goes from 250 to 900.

See Your Credit Score instantly! >>>

The percentage of Americans in each FICO credit score range is as follows:

What is a credit report?

You can think of your credit report as a report card of your debt and access to debt. It keeps track of all your debt-related accounts to determine whether you’re a trustworthy borrower to credit card companies, mortgage lenders, and other types of lenders.

There are several ways an account or inquiry can show up on credit reports:

- You applied for credit (hard credit inquiries) at a credit card company or other type of financial institution.

- You opened a line of credit with a lender (payments missed/made)

- You receive a tax lien, bankruptcy, civil judgment

- You had a collection account due to an unpaid utility or cell phone plan

Your credit report shows all open and closed accounts and whether they’re in good standing. The better you are at paying your credit obligations on time, the better your credit report (and score) will be as payment history makes up 35% of your FICO score. If you have a negative payment history, you’ll probably find your score will be lower, and you might have a harder time getting approved for credit.

Here’s an overview of what you’ll find on your credit report:

- Opening date of the credit obligation

- Payment history

- Outstanding balances

- Types of credit accounts (credit cards, installment loans, etc.)

You can obtain your free credit report every week from each major credit bureau — TransUnion, Equifax, and Experian.

What is the difference between credit and debit?

When you open a checking account with a bank, they issue you a debit card to withdraw money from the ATM and pay for goods online or using a card reader (like at the supermarket).

However, when you apply for a credit card with your bank or other card issuer, once approved you’ll receive what’s called a credit limit. A credit limit is the maximum, in total, you can borrow on your credit card at any one time. If it’s a secured credit card, then you’ll have to put some or all of the money into a savings account or certificate of deposit upfront. A secured credit card can be a helpful tool looking to build up their credit if you have a low credit score or limited credit history. The cash deposit you pay upfront acts as a guarantee for your credit line.

For example, you may have to put down $99, and then the bank gives you an unsecured portion of the line of credit, totaling a $500 credit limit. Some banks will do this or ask you to put the entire $500 on there, so your money is the collateral if you don’t manage your account responsibly.

See Your Credit Score instantly! >>>

Using a debit card

Each time you use a debit card, the money is removed from your checking account. The money comes from funds you deposit as cash, check, or direct deposit (such as from an employer). Once your funds run out, then you can no longer use the debit card until you add more money to the account.

Using a credit card

When you use your credit card, you make purchases against the available line of credit. You have the option of either repaying it all at the end of each billing cycle. Or you can pay a minimum balance.

If you choose the latter, then the remaining balance on the card will accrue interest.

For example, let’s say you have $500 on your credit card and you use $400 for that month. When your bill comes, you can either pay back the full $400 without credit card interest. Or you can just pay $50, and the remaining $350 will have 22% interest added to the total each month until you pay it back in full.

If you take several months to repay this, then you’ll end up paying much more on top of the $400 you borrowed initially. So it’s wise to pay off your balance as quickly as possible.

What are the different types of credit?

One of the factors determining your credit score is having a good credit mix in your credit report. So simply having 5 credit card accounts isn’t going to get you the best credit score possible.

You need to balance out your credit history with different types of credit to show you can handle various forms of financing.

Here’s a look at the different types to add to your credit profile.

Installment credit

An installment loan is a loan you repay over time through monthly payments. Examples of installment credit include student loans, auto loans, business loans, personal loans, and mortgages.

With an installment loan, a lender agrees to lend $X to you, which must be repaid in X months. For instance, you may borrow a car loan for $15,000 and have 36 months to repay it. Your monthly installment payments will be $416 plus interest.

Revolving credit

Revolving credit accounts allow borrowers to borrow money up to a maximum credit limit, then pay it back over time and borrow again as needed. Examples of revolving credit include credit cards, retail credit cards, and home equity lines of credit (HELOCs). This differs from installment credit where you typically borrow a fixed amount for something like a car and pay that amount back over time until it’s paid off.

Let’s say you have a credit card limit of $1,500 — you can choose how much or how little you use. You could make purchases that amount to $1,000 using your credit card, then if you pay off the full amount by the due date, you won’t pay any interest. Alternatively, if you only make the minimum payment by the due date, you will pay interest on the remaining balance that you have not paid off.

Why do you need credit?

Being able to qualify for a loan or credit card sounds great — but is managing your credit something you should be doing? Is it really worth it?

Well, credit is about more than getting financing. If your credit is poor, you’ll have to deal with getting denied apartments or paying higher deposits just to move in. Having a good credit score can also potentially save you money.

Let’s say you’re approved for a high-interest auto loan with a low credit score. When you purchase insurance for the car, the cost also could be higher because of your poor credit. Aside from financial products, poor credit can hurt another area of your life — employment. Some employers today are checking applicants’ credit reports and may use them as one factor to determine whether or not to hire them.

How do you build credit?

Building credit from scratch isn’t difficult to do. However, it does require consistency and commitment. You can’t expect to establish and raise your score overnight. It takes time to build credit (how long depends on your credit report). To start from scratch, you may need to do things like apply for secured credit cards, pay your bills on time, and keep your credit balances low in relation to credit limits (preferably below 10% usage).

You can even try credit piggybacking to take advantage of someone else’s excellent credit and become an authorized user of their account. However, this can be a risk if the owner of the account misses payments or does not manage their credit responsibly as your credit will be affected as well.

There are also alternative methods you can use, such as reporting your rent and utility payments. Or getting a credit builder loan, which can be a great way to add a mix of accounts to your report (this is an installment loan).

See Your Credit Score instantly! >>>

Bottom Line

Understanding how credit works will empower you to make better financial decisions. This way, you can apply for financing, jobs, and places to live without the worry of denial.

Hopefully, this guide and its resources will help you build your credit rating so you can enjoy the freedom and benefits it can bring.